Diversified Energy Share Price Trends & Analysis

Investing in energy sector stocks can be lucrative but also requires a keen eye for detail and smart investment strategies. In this article, we will explore the trends and analysis of diversified energy share prices, providing a comprehensive overview of the energy industry’s current market dynamics and performance.

The energy sector is a vast and dynamic space, with traditional as well as renewable energy companies vying for investor attention. As a result, the sector’s stock prices are subject to various economic, political, and environmental factors that affect them positively or negatively.

Understanding these factors and how they impact stock prices is crucial to making informed investment decisions. This article will delve into the finer details of energy industry stocks, providing expert analysis and insights into the market’s current state.

Key Takeaways

- Diversified energy share prices fluctuate due to various economic, political, and environmental factors.

- Traditional and renewable energy companies are competing for investor attention, leading to a dynamic market.

- Informed investment decisions require a keen understanding of the energy sector’s current trends and analysis.

- Expert insights can provide valuable information on sustainable energy investments and opportunities.

- Green energy investment opportunities continue to emerge, with potential for high returns on investment.

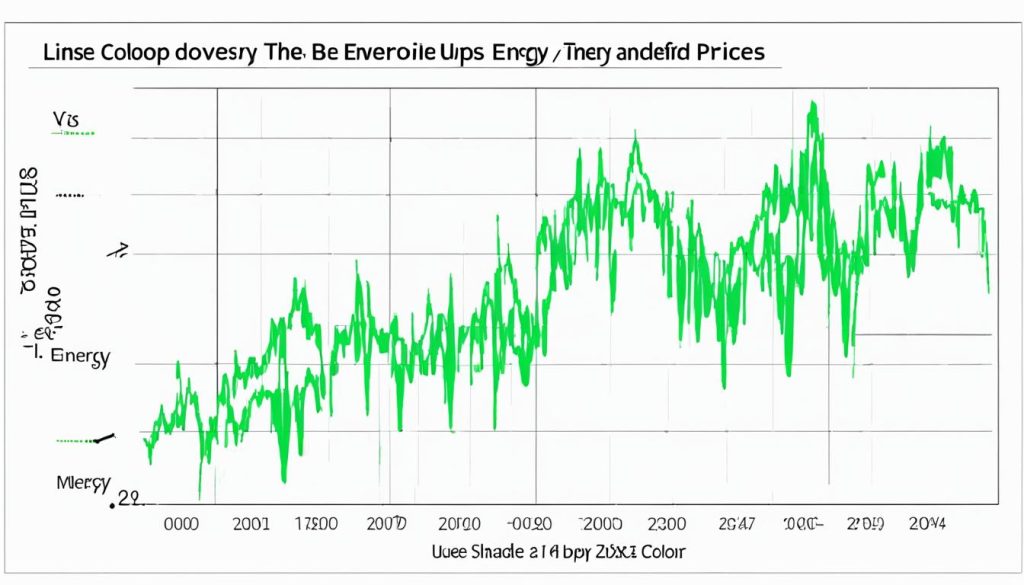

Energy Stock Price Performance

Investors in the energy sector closely monitor the performance of energy stocks in the market. The energy industry comprises both traditional and renewable energy companies, and the share prices of these companies are subject to volatility and fluctuations.

Factors that influence energy stock prices include government policies, oil and gas prices, technological advances, and environmental regulations. Expert analysis and insights are essential in understanding these factors and making informed investment decisions.

Energy stock prices can be affected by a company’s financial performance, including revenue and earnings growth. Shareholders may also earn dividends, which reflect the company’s financial stability. To mitigate the risks, investors may engage in diversified investment strategies that include a mix of traditional and renewable energy stocks.

| Energy Companies | Stock Price (GBP) | Percentage Change |

|---|---|---|

| BP | 2.10 | -0.45% |

| ExxonMobil | 3.41 | +1.03% |

| Shell | 1.43 | -0.18% |

| NextEra Energy | 5.22 | +0.76% |

Energy industry shares are not immune to external shocks, and their value can be impacted by supply and demand factors such as geopolitical tensions, natural disasters, and pandemics. While renewable energy stocks have shown strong growth in recent years, traditional energy companies still dominate the market, and their share prices are subject to constant analysis and scrutiny.

Expert analysis and insights are essential in understanding energy stock performance, identifying investment opportunities, and mitigating risks.

Sustainable Energy Investments

The demand for energy is constantly increasing, and as a result, many investors are turning to sustainable energy investments. Renewable energy stocks and clean energy companies have shown strong performance, making them a promising option for environmentally conscious investors.

According to recent market research, renewable energy stocks have outperformed traditional fossil fuel stocks, with the global clean energy share performance rising by 142% in the past five years. Clean energy companies, such as Tesla and NextEra Energy, have also experienced significant growth in their stock prices and market capitalization.

Investing in green energy also provides significant environmental benefits. It helps to reduce carbon emissions and promotes the transition to a cleaner and more sustainable global energy system.

Green Energy Investment Opportunities

The green energy sector offers various investment opportunities, including direct investments in clean energy companies, renewable energy funds, and exchange-traded funds (ETFs).

Investing in clean energy companies can offer high returns, albeit with higher risks. Careful analysis of the company’s financials, its business model, and its future prospects are essential. Additionally, renewable energy funds and ETFs can provide diversified exposure to the green energy sector, enabling investors to access multiple green energy companies.

Expert Opinion and Analysis

“The future of energy is green, and investors who want to pursue profits without compromising the planet cannot ignore the sector’s extraordinary potential.” – Antonia Oprita, Investing.com

According to experts, continued government support and aggressive policy measures that incentivize clean energy adoption will further drive the growth of the green energy sector.

With the continued growth of renewable energy stocks and the increasing focus on sustainable energy investments, investors have a unique opportunity to make a positive impact on the planet while achieving significant financial returns.

Conclusion

Based on the analysis and insights gathered, it is clear that the energy sector stock prices have been subject to several fluctuations in recent times. While traditional energy shares have been affected by the pandemic, renewable and clean energy stocks have proven to be more resilient. With the increasing demand for clean energy, green energy investment opportunities are ripe for potential investors.

It is essential to conduct thorough research and analysis before making any investments in the energy sector. The current trends indicate that sustainable energy investments are the way forward, and investors must focus on renewable energy stocks and clean energy company shares. The sector may still face challenges, but the potential for significant returns on investment in the future makes it a viable option for investors.

In conclusion, while the energy sector stock prices may remain volatile in the short term, green energy investment opportunities remain an attractive option for the long haul. Investors need to stay abreast of the latest market trends and consult expert analysis to make informed decisions to maximize their returns on investment.

FAQ

What factors influence diversified energy share prices?

Diversified energy share prices can be influenced by various factors, including market demand, global energy policies, geopolitical events, technological advancements, and oil and gas prices. It is important to consider these factors when analyzing the performance of diversified energy shares.

How can I track energy stock prices?

There are several ways to track energy stock prices. You can use financial news websites, stock market apps, or online trading platforms to access real-time stock prices. Additionally, many financial institutions offer market research reports that provide detailed analysis of energy company stocks.

What are the different types of renewable energy stocks?

Renewable energy stocks encompass various sectors, including solar, wind, hydro, bioenergy, and geothermal. Each sector represents companies that generate electricity from renewable sources. Investing in renewable energy stocks enables you to support sustainable energy production and potentially benefit from the sector’s growth.

What are sustainable energy investments?

Sustainable energy investments refer to financial allocations made towards companies and projects focused on clean and renewable energy sources. These investments aim to support the transition to a low-carbon economy and promote environmentally friendly energy production. They can include investments in renewable energy companies, green bonds, and sustainable infrastructure projects.

Are there any green energy investment opportunities in the market?

Yes, there are several green energy investment opportunities in the market. As the demand for clean and renewable energy continues to grow, investing in companies involved in solar power, wind energy, electric vehicles, energy storage, and sustainable infrastructure can offer potential returns. However, it is essential to conduct thorough research and consult with financial advisors to make informed investment decisions.